Doing Business in Romania – Legal 500, 2021 edition

Author: Valentin Voinescu

Introduction

Romania is going through two processes of transformation.

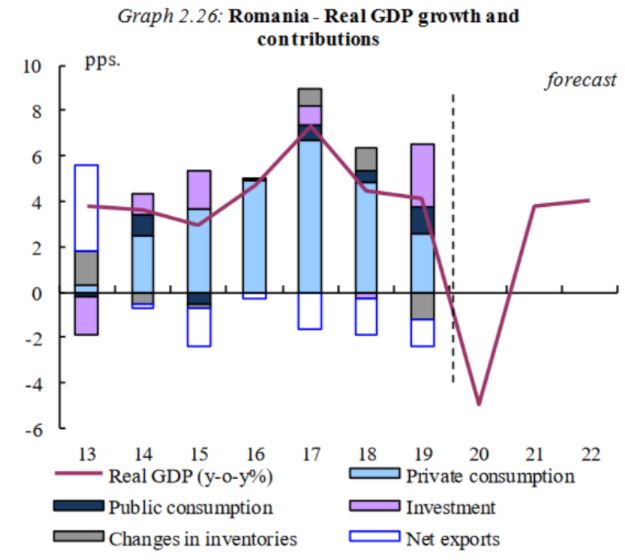

One process, which has started more than 30 years ago, is one of continuous modernization and convergence with its EU more developed counterparts. Albeit for the average Romanian this may not be entirely apparent, Romania has indeed evolved dramatically from an economic standpoint, in many years showing more than 3-4% real GDP growth, well above the European median.

The second is one of recent transformation from facing a deep medical crisis, lockdowns and constant restrictive measures which have divided the population between pro and anti COVID measures, vaccines, etc. It is difficult to predict how this process will change mentalities, the approach with regard to the state, or the relationship between the private and public sector, in the long run.

Romania through the coronavirus crisis

In a nutshell, Romania went through the crisis surprisingly well, by comparison with some of the more developed states, as well as with what was expected (an almost catastrophic meltdown of the economy).

Some still comment that this is just “the calm before the storm” and that inflation, for once, is coming. Inflation has simply ravaged Romania in the 90s and is well kept in mind by the National Bank of Romania, an institution that is very conservatively oriented towards controlling this metric as a zero priority, before any others.

Others question the country’s further capacity to grow due to the very low level of financial intermediation (a quarter of the EU average) and the staggeringly high level of commercial credit, which can quickly turn into a complete blockage of the supply chain (and it has in the past, in the 90s and early 00s as well).

Vaccinations

Romania’s COVID-19 vaccination campaign started on December 29, 2020. Structured as a 3-phase process, the campaign has as objective the vaccination of 10.4 million people (or 70% of the country’s population) by the end of September 2021, according to official declarations.

Up-to-date information and data on the status of the campaign are available here (in Romanian) https://datelazi.ro/ and here (in English) https://ourworldindata.org/covid-vaccinations

Romanian drought

The COVID-19 pandemic was not the only one ravaging the Romanian economy. In 2020, 2.2 million hectares of arable land, a quarter of Romania’s cultivated land was subject to extreme drought. As agriculture remains one of the important business activities in Romania (with more than 20.5% of the active population working in the agricultural sector according to the data published by INS[1]), Romania has dealt with a great blow as a result of the extreme drought.

The impact of the drought is shocking when looking at the crops yield in 2020 compared to the previous year. The production of grains (wheat, corn, oat) has seen an important drop of 37,6% compared to the previous year due to lack of irrigation systems[2].

2021 is so far expected to over perform many previous years in terms of crop yields and is another encouraging element going forward, but the “scarring” left in the economy by the 2020 drought still remains to be assessed.

The Romanian economy

Romania’s economy was indeed hardly hit by the first lockdown measures enacted, registering a 12.2% contraction in the second quarter of last year. However, the economy rebounded by 5.8% in the third quarter of 2020, the last quarter of the year will most likely show a weakened economic activity as a result of the new wave of infections that led to reinforced restrictions.

According to the European Economic Forecast[3], real GDP is expected to grow by 3.8% in 2021 and by 4% in 2022. Given that more people have access to vaccines and restrictions may start to be lifted, forecasts expect that private consumption shall also recover strongly from the second half of 2021.

Source: ECFIN

The National Bank of Romania Financial Stability Report dated June 2020[4] warns that the risks to financial stability, already greatly impacted by the COVID-19 pandemic, can also be heightened by the interactions with the structural vulnerabilities of the Romanian economy:

- The weak payment discipline in the economy and vulnerabilities in the company’s balance sheets: Romania has a relatively high value of overdue payments in the economy and also a notable share of companies with equity below the minimum requirements set by law.

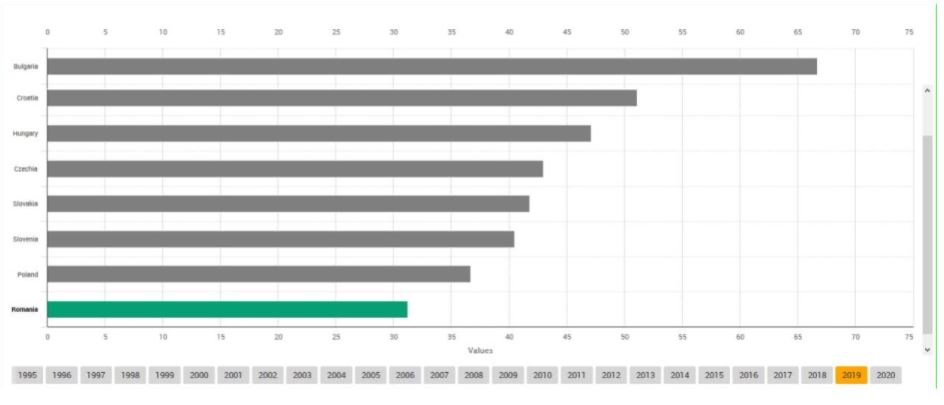

- Low financial intermediation: we continue to rank last in Europe, while other countries in our region boast significantly higher values of financial intermediation (34.7% in Hungary, 51.9% in Poland, 53.3 in Bulgaria, 53.4% in Czech Republic).

Source: Eurostat[5]

- The demographic problem: the number of elderly persons increased further, reaching 17% of the total population, while the persons aged below 14 years amount to merely 14.6% of the total population.

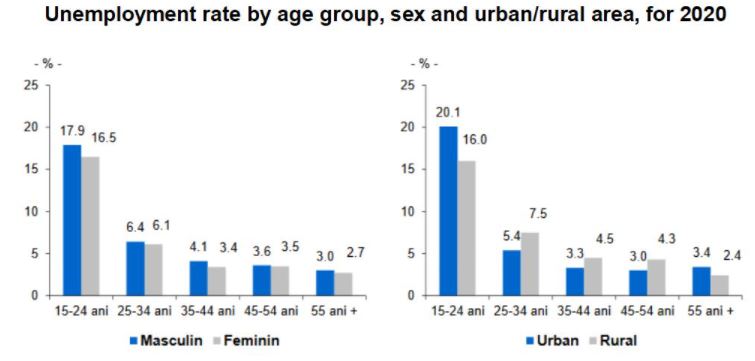

World economies are also struggling with rising unemployment rates and Romania is no exception. According to the data published by the Romanian National Institute of Statistics, the unemployment rate in 2020 was 5%, 1.1% higher than the previous year (3.9% in 2019) and, unfortunately, the highest unemployment rate was among young people (a rate of 17.3% for people aged between 15 and 24 years old).

Source: The Romanian National Institute of Statistics (INS)[6]

Corporate insolvencies during the pandemic

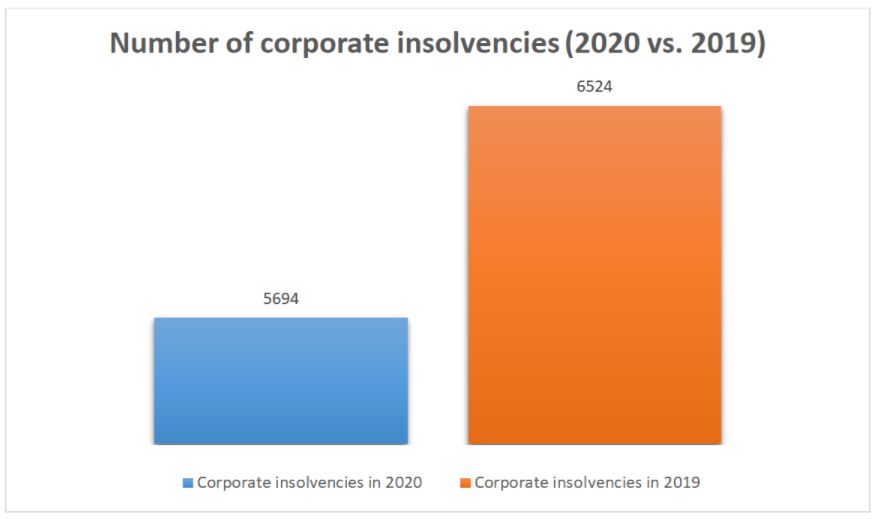

There is no doubt that lockdown measures intended to prevent the spread of the coronavirus have been a hard hit for companies across all Romanian industries, as most business activities have declined and some were even brought to a halt.

The past financial crisis has shown that such a decline of economic activity is closely linked to surges in insolvency fillings. Therefore, in an endeavor to implement the lessons of the 2008 global financial crisis, certain temporary measures with respect to the insolvency obligations of companies were launched during the state of alert enacted in Romania (which is still currently in place). The measures which intended to implement relaxed conditions for the initiation of insolvency proceedings seem to have stemmed, at least for a while, the looming tide of insolvencies, as the insolvency cases dropped in 2020 compared to 2019.

Source: Romanian Trade Registry[7]

However, the support programs will be eventually withdrawn and the economic effects of the pandemic will most likely be visible on the long term, meaning that business insolvencies are likely to surge in the following years.

As the feared wave of insolvencies was postponed rather than prevented, and since Romania lacks a diverse toolkit that could enable a distressed debtor to swiftly restructure their business, we still face a great challenge ahead, should measures not be taken.

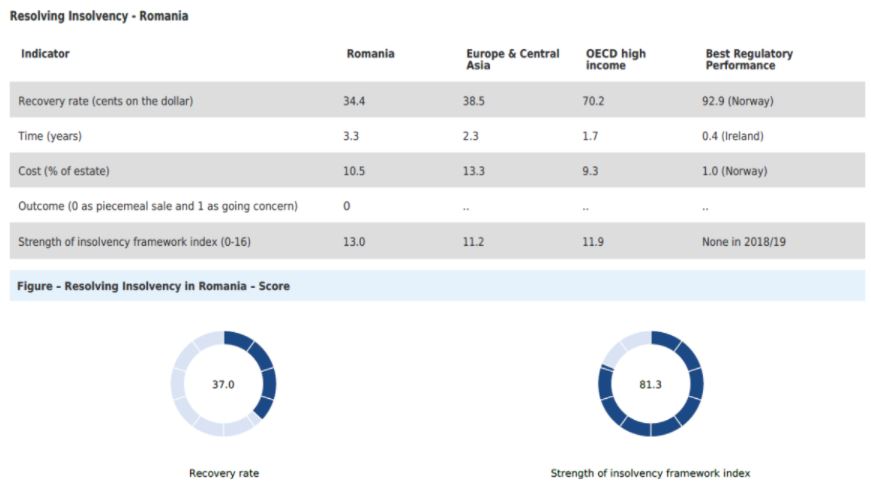

In the Doing Business 2020 report[8], Romania currently ranks 56th worldwide in resolving insolvency, four places down compared to the previous year. The average duration of proceedings is much longer in Romania (3.3 years) compared to the average duration for Europe (2.3 years), the recovery rate is also low (34.4 per cent while in high-income OECD countries the indicator can go up to 70.2 per cent) and at relatively high costs (10.5 per cent of the asset value).

Source: Doing Business 2020, World Bank Group

Opportunity for reform

The implementation into Romanian national law of the Directive (EU) 2019/1023 on restructuring and insolvency (the „Directive”) could represent the opportunity to reform the entire Romanian insolvency and restructuring system.

Romania is bound to adopt and publish, by July 17 2021, laws and regulations implementing into national law the provisions of the Directive. To this end, a draft law which aims to amend the existing insolvency law (i.e. Law no. 85/2014 on insolvency prevention procedures and insolvency proceedings) has already been made available for public consultation in March – April 2021.

There are however certain key aspects prescribed by the Directive which seem to have been overlooked, at least at this stage, by the draft law. These would need to be further addressed in order to provide for a truly modernized and enriched reform of the Romanian restructuring proceedings, such as:

- the implementation of early warning signs which would help to timely address a crisis;

- introducing a new regulated profession, namely the “restructuring practitioner”;

- a proper definition of the concept of “difficulty”, a central component of the new legislation; and

- designing restructuring frameworks that can work efficiently without excessive involvement of courts, or extensive bureaucratic processes.

Footnotes

[1] https://insse.ro/cms/sites/default/files/com_presa/com_pdf/somaj_2020r.pdf

[2] https://insse.ro/cms/sites/default/files/com_presa/com_pdf/prod_veg_r20.pdf

[3] https://ec.europa.eu/info/sites/info/files/economy-finance/ip144_en_1.pdf

[4] https://www.bnr.ro/DocumentInformation.aspx?idDocument=35334&idInfoClass=19968

[5] https://ec.europa.eu/eurostat/databrowser/view/TIPSPD25/bookmark/bar?lang=en&bookmarkId=31557070-ce85-46b3-9af6-3a2125c72820

[6] https://insse.ro/cms/sites/default/files/com_presa/com_pdf/somaj_2020r.pdf

[7] https://www.onrc.ro/index.php/ro/statistici?id=252

[8] https://www.doingbusiness.org/content/dam/doingBusiness/country/r/romania/ROM.pdf

This article appeared in the 2021 edition of Legal 500 Doing Business, https://www.legal500.com/doing-business-in/romania/.